BONUS: The Pay Per Lead List of Booming Industries (Even During a Recession!)

[maxbutton id=”3″ ]

If I’ve been asked this question once, I’ve been asked it a thousand times (and it doesn’t matter how long people have been in the lead gen game):

“How do I get clients?”

Or, more accurately (‘cus getting local clients is easy):

“How do I get clients with national coverage and deep pockets?”

When agency owners have been working with retainer contracts, the Pay Per Lead Model can be a bright light in the darkness.

Agency owners on retainers are so tired of:

- Spending 80 hours a week juggling 15+ clients for a measly couple of thousand a month

- The constant paddling to keep afloat

- Doing everything and anything for clients, such as SEO, webite design, copywriting and building landing pages

‘Cus when you’re on the retainer contract hamster wheel, all of your lil’ hamster feet are going to be running as fast as they can to keep things moving.

The Pay Per Lead Model takes a broken system and reworks it to suit the agency owner and their business needs.

- There’s no need to have 15+ clients. I have a multi-million dollar Pay Per Lead agency with just 7 clients. Some of my students are making over $100k a month with only ONE client.

- The Pay Per Lead Model focuses you and gets you working in a specialist niche, rather than forcing you into the position of a “Jack of all Trades”. So many agency owners on retainer contracts are juggling 15 niches or more.

- The Pay Per Lead model’s key offer for clients is leads and nothing else. No more SEO or website design. No more copywriting, building landing pages for your clients, and waiting months for them to be approved. The client pays for the leads, and you provide them, it’s as simple as that.

I’ll get more into the benefits of the Pay Per Lead Model later on in this article.

But, as you gain more experience in Pay Per Lead, you’ll want to stop working with “small-time” clients (doctors, dentists, gyms), and look for clients that will help grow and scale your agency.

And some of you may have been in Pay Per Lead for a while. You also want to grow and scale your business, but you’re also aware of how crazy the world has been over the last few months.

We may not be in a recession yet, but it’s heading our way. As other businesses flounder, you want to find those clients with national coverage and deep pockets to keep your agency ticking over. (And, by ticking over, I mean earning $100k+ a month!)

Problem is, where to start?

Just breathe.

If running an agency has taught me anything, through every up and down, victory and crisis, it’s resilience.

No matter what agency life has thrown at me so far, I’ve always been able to bounce back.

I also believe that digital marketers are currently in a better position to survive than 90% of other businesses.

As times have got more financially volatile, my Pay Per Lead business model has proven itself to be the calm in the storm.

You see, despite everything, there are still thousands upon thousands of businesses out there that are desperate for leads.

These are the kind of businesses that have a recession-proof offer. They’re ones that can survive even when people are losing their jobs, have less money to spend, and are on restricted travel.

And that’s what I want to talk about in this post today. Whether it’s down to the banks, or a pandemic, or an oil crisis, there have been recessions throughout history.

Don’t get me wrong, there have been plenty of casualties. But each time, the country (or the world) has managed to rebuild itself economically and make things even better than before.

I.e. some businesses managed to thrive where others failed.

If you want to survive as an agency in times of economic hardship, you need to identify those businesses and industries, and you need to focus your efforts on catering to them. You’re in a unique position now where you can also stay afloat, as long as you adapt quickly and do the work.

In this post, I will show you:

- Why my Pay Per Lead Model is the perfect way to get you through any recession – now, or 5, 10 years in the future

- How to identify the industries that can make your agency prosper, even in times of economic hardship

- How to prospect and land those clients that are “worth your time”

- What to charge per lead in your industry, and the best payment model for you.

No more excuses. No more feeling sorry for ourselves.

This information is the entire “recession-proof” package to getting your agency on the $100k+ a month level, all with 7 clients or less.

It’s time to kick ass.

What is The Pay Per Lead Model?

The Pay Per Lead Model works on the assumption that clients want leads and nothing else.

Unlike retainer contracts, there is no binding obligation to work with each other for 2-12 months, nor any lengthy paperwork. Pay Per Lead agencies can work with clients for as little as a week (though obviously hope for much longer).

So, the model is pretty simple. You (the agency) generate leads for X amount per lead, then sell them to the client for Y per lead.

Y – X = N. The N is your gross profit.

Let’s use a quick example: say an agency is working with a solar panel installation client. The solar panel company asks for 1000 leads in a week.

On the Pay Per Lead Model, the agency usually pays for the ad spend. They know, from experience, that they can generate leads for about $15 in the solar niche.

The client agrees to pay $30 per lead. The agency pays $15000 on ad spend ($15 cost per lead x 1000, the number of leads requested by the client). In return, the client pays them $30000 ($30 per lead x 1000, the volume of leads required).

$30000 – $15000 = $15000. So, the agency is making a $15000 profit for $15 per lead.

Once you have your funnel dialled in, the Pay Per Lead Model works with any platform you choose to advertise with. That could be:

Snapchat

YouTube

Yahoo Gemini

Google Search

Google Display Network

Taboola/Outbrain

If you’ve got a hot SEO game, and rank high on Google, you can generate leads organically and send them to clients. You can produce organic leads via a lead generation website.

However, most clients you’ll want to work with will order leads at a large volume and over a specific period (i.e. 100-5000+ leads in a week). Organic leads take time, and there’s no consistency in volume week by week. That’s why a lot of agencies on the Pay Per Lead Model generate leads using paid ads.

Yes and no.

On the Pay Per Lead Model, the client is paying you for the leads you generate.

This means you’re completely in control. You run all ads from your personal Ads Manager, and the client has no access to it.

However, to get the highest-quality leads, you’ll need to create all the sales funnels for your clients. That means you’re responsible for:

- All ads (creation and management)

- Advertorials

- Quizzes and surveys

- Landing pages

- Thank you pages

- Lead validation systems

- Lead segmentation strategies (if necessary)

It sounds like a lot of work, but it gets easier as you get more experience.

This is why, with the Pay Per Lead Model, I recommend working in one speciality niche – at least, at first. Choose a niche with a lot of clients to work with. I’ll tell you more about my recession-proof niches later on in this article.

If you choose your niche wisely, you’ll soon know what works and what doesn’t.

For example, say you land a client in the solar panel installation niche. After some trial and error, you find a funnel that works.

For your next client in the solar panel installation niche, if you have chosen 1-2-1 delivery, rather than a lead generation website, you can use a very similar funnel. Just adjust the branding, the tone, and so on to suit the other client and their regulations. You know it’ll work, as you’ve already tried and tested it.

There are also other, small, ways to make your life easier. Building landing pages, advertorials, etc., doesn’t mean you need to master coding. Look for a good drag-and-drop page builder, like Unbounce.

Once you’ve got used to the software, building pages will take hours, rather than months. It’s well worth the monthly fee.

Plus, when I worked with retainer contracts, any changes I wanted to make to the funnel had to go through the IT department. Now, I just take the pages I’ve made and attach them to the client’s site using a subdomain. Easy!

The Benefits of The Pay Per Lead Model For Clients

Clients know a fabulous offer when they see one, and the Pay Per Lead Model is one of them.

Here are 5 reasons why clients will be falling over themselves to take you up on your offer, recession or not.

Clients know a fabulous offer when they see one, and the Pay Per Lead Model is one of them.

Here are 5 reasons why clients will be falling over themselves to take you up on your offer, recession or not.

1. The Pay Per Lead Model means there’s no long-term commitment

With the Pay Per Lead Model, there’s no time-consuming paperwork or 3 to 12-month commitment.

If the client is reaping the benefit from the leads, they can renew the agreement with your agency the following week. However, if the leads aren’t up to scratch, they aren’t bound to working with you again.

This dramatically reduces any risk when they’re looking for outside parties to generate the leads they’re desperately looking for.

Of course, if you give the client high-quality leads, there’s no question of them not wanting to work with you again.

2. The client can be specific about the leads they want

As agency owners on the Pay Per Lead Model get paid on results, we’re going to be extra-diligent about lead quality.

If the client wants a specific type of lead (i.e. only people who are ready to take action immediately), they can give that information to your agency. It’s then up to you to ensure that the leads match your requirements. Superior lead generation like this is incredibly valuable.

It also means the client will only pay for leads with the high probability of conversion.

3. Agencies on the Pay Per Lead Model will go out of their way to provide value

One of the biggest arguments in the “Pay Per Lead vs Retainer” debate is that agencies on the Pay Per Lead Model won’t help with anything other than generating leads.

That’s not true. If the client has a low contact rate with a batch of leads, that’s a problem for them, which, in turn, is a problem for the agency.

Say, for example, the client doesn’t have clever direct response autoresponders, nurture sequences or follow-up systems within their business. A good lead generation agency (like yours!) will help the client identify the problem, make suggestions, then execute any agreed changes.

The client is paying for a quality product, so it’s up to the agency to ensure quality is achieved.

4. Agencies on the Pay Per Lead Model build your funnels for free

Again, there are no “extras” to pay for. The client will just be paying for the leads.

This means all their ads, advertorials, quizzes, landing and thank-you pages are built for “free”. A good agency knows what works, so the client won’t have the stress or the time-commitment of building funnels from scratch.

For 1-2-1 delivery, Pay Per Lead agencies run all the information by the client before the funnel goes live, to make sure that it’s accurate. When the funnel is live, the client won’t need to “supervise” what’s going on, letting them work on the business rather than in the business.

On the other hand, if your agency has lead generation websites, you’ll have one funnel that you’ll use to deliver leads to multiple clients. The clients won’t have a say in your funnel at all, as it your personal lead generation brand.

(On another note, DON’T show your ads to your clients – they may try and rip you off!)

5. The Pay Per Lead Model means the client is guaranteed X amount of leads

Whether the client is looking for quality, volume or both, they agree with the agency how many leads they want per week.

It’s up to the agency to hit that target, with all of the client’s specifications. This contrasts with the Retainer Model, where the quality and quantity of leads may differ drastically from month-to-month. The Pay Per Lead Model works on consistency, giving the client instant peace of mind.

If you’re smart, you’ll highlight all these advantages when looking for new clients. In a recession, they’ll especially like the fact that a majority of the risk is in your hands. They’ll be chomping at the bit!

The Advantages Of The Pay Per Lead Model For Agencies/Freelancers/ PPC Professionals

1. The Pay Per Lead Model Is A Much Easier Sell

I’ve already covered this in a previous point, but…

As I said, clients dread retainer contracts. They don’t want a long commitment to an agency/freelancer or PPC professional they barely know or trust.

Retainers also need to take into account the ad spend and extras, such as SEO and sales training. With the Pay Per Lead Model, on the other hand, clients will only need to pay for leads by volume or leads by conversion. As far as they’re concerned, all risk is in the hands of the agency owner.

2. Clients On The Pay Per Lead Model Tend To Have Deeper Pockets

For the clients with the deeper pockets, they don’t care how much a lead costs, as long as it gets them an ROI. This may be because they sell a “high-ticket” product or service worth thousands of dollars. A $30 lead is nothing if that lead converts to a $3000 customer.

And, clients with deeper pockets tend to have better sales teams, follow-up systems, websites, branding, and so on. This means a lead generation agency on the Pay Per Lead Model can spend less time hand-holding, and more time doing what they do best.

3. On The Pay Per Lead Model, You’re Your Own Boss

On retainer contracts, you’re pretty much at a client’s beck and call. That’s annoying, as you probably left your 9-5 job to become your own boss.

If they’re smart, clients will look at you as an investment, rather than an employee. See, on a retainer, you’ll be paid a flat fee, regardless if the leads are any good or not. On the Pay Per Lead Model, repeat orders depend on high-quality leads. If you’re good at what you do, clients will fall over themselves to buy leads from you.

You’ll be viewed as the person driving the client’s business growth. As the scales are balanced (the client needs you as much, if not more than you need them), there’ll be no employer/employee dynamics. Most clients will treat you, over time, as a partner.

You’ll also own all your funnels, websites, and so on. You won’t spend hours (or days!) waiting for permission from the client, or hanging on for the IT department to change parts of the website. You’ll be less dependent on the client if anything falls through.

4. The Pay Per Lead Model is a Super-Fast Way To Scale Your Business

Once you’ve had some practice in your chosen niche, and you’ve got funnel templates that work, you can bring the cost per lead right down. Say, for example, you start off by generating leads for $20 and selling them for $30. That’s $10 profit per lead.

As you gain more experience in that niche, you find that you can generate leads for $15. The client is still paying $30 per lead, so your profits have gone up to $15 per lead.

Scaling like this wouldn’t be possible with a retainer contract. You could be generating leads for $2, and, in most cases, you’d still get the same fixed fee as agreed with the client.

On the Pay Per Lead Model, you work out how much to charge a client per lead. If the CPL goes down during the duration of your campaign, the client will still pay the same amount as agreed. If you have multiple clients within the same niche, you can get a really low CPL. That means you’ll take a fat profit from each client, scaling your business accordingly.

5. On The Pay Per Lead Model, You Can Segment Your Leads And Sell Them To Multiple Clients

Say you’re generating leads for a client in the car sales niche. Client A wants leads that are ready to take a specific action – they want to sell their cars immediately. Client A is prepared to pay $30 for leads that fit this criterion.

Out of the 100 leads you generate, your funnel suggests that only 50 are a match (we generally use quizzes or survey funnels that tell us this). If you send all 100 leads to Client A, Client A would be within his rights to complain about the lead quality.

Client B, on the other hand, is willing to take leads that will enter a nurture sequence. He offers you $10 per lead and commission for any leads that convert.

This way, no leads are “wasted leads”, and you’ll be breaking even or making a profit on all of them. Lead segmentation can go on for as many clients as you choose to take on in that niche.

As you can see, the Pay Per Lead Model has a whole host of advantages for both you and the client.

BUT, to make the model truly successful during a recession, you’ll need to put the research into finding those “recession-proof” industries.

Luckily, I’ve done it for you. Up next is “Choosing Clients In Recession-Proof Industries”.

Choosing Clients In “Recession-Proof” Niches

Don’t forget to grab your bonus content, with an even more in-depth list of Recession-Proof Niches:

[maxbutton id=”3″ ]

Not All Niches Are Created “Equal”

Recession or not, before you start reaching out to clients, you need to spend some time finding a niche.

If you’ve been in the Pay Per Lead industry for a while, feel free to skip ahead to other sections of this post.

For the rookies among you, choosing a niche in times of a global financial crisis means finding an “evergreen” offer. This means searching for industries that will continue to thrive in times of economic hardship: i.e. services that people can’t do without.

It’s not as difficult as it seems, and I will talk about such verticals in just a minute.

But before we go ahead, a quick word of warning.

As I’ve mentioned in other posts, not all niches are created “equal”. This advice applies to the Pay Per Lead model in general. Still, it’s particularly relevant in times of recession or economic downturn.

That’s why I want to talk about clients to avoid with the Pay Per Lead Model before I move on. Please note that this has nothing to do with how valuable the client is as a business, nor how they run their company.

It’s mainly due to other factors, such as:

- Location

- The population of that location

And, or either:

- The number of customers that business can handle

- The likelihood of that business remaining stable during a financial crisis.

In this instance, I’m talking about local businesses such as gyms, plastic surgeons, and dentists.

There are two reasons for this. Firstly, from a Pay Per Lead standpoint:

- Small, or independent, businesses tend to get overwhelmed when they have too many leads. This is because, usually, they don’t have the systems in place to handle them. If you’re getting paid by the lead, and they can only deal with 25-30 a week, you’ll not be making the same level of profit you would with a “bigger” client.

- These small businesses can only serve their local community. If that’s 10,000 people, you’ll burn through your audience. The audience will experience ad fatigue very quickly, causing CPLs to rise too high.

And if the country (or the world!) finds itself in a recession:

- Small businesses are often hit the hardest (especially those that offer “luxury” services)

- Reduced cash flow and reduced demand mean the firm will lose business

- Workers will get laid off due to budget cuts (less people to manage and close any leads)

Marketing is the first thing to be thrown out of the window when small businesses face financial restraints. Though advertising is what they need to do most, many small businesses drown under a mixture of pressure and lack of funds.

To keep your agency afloat during a recession, you need to choose clients with a national appeal who provide a service that people can’t do without.

Plus, with a national client, it’s 150x easier to generate leads. With a nationally appealing offer, the whole country’s population is your potential market.

The bigger the advertising pool, the less your leads will cost to generate – even in times of economic hardship. You can produce more leads for a lower price, which you can then sell to your client for a big profit.

There are two ways to find this golden offer, and they are:

1. Search for clients that work in a “money for jam” offer

2. Find a sub-niche, or “niche within a niche” in a high-volume vertical.

Let’s start with “money for jam” industries and how to find them.

What Is A “Money For Jam” Niche?

“Money for jam ~ idiom. If something’s money for jam, it’s a very easy way of making money” (usingenglish.com).

So, as you can guess, a “money for jam” niche is a way of making money, or something of value, quickly and without too much effort.

In this case, “money for jam” benefits the customer, the business, and the person generating leads.

- The customer benefits because they receive a valuable service in exchange for little to no money or effort. In some “money for jam” niches, they’ll only pay if the service was successful.

- The businesses involved in “money for jam” offers often don’t charge for their help up front . They’ll just take a cut if the claim/service was successful for the customer.

- The person generating leads will have a vast audience for a typical “money for jam” offer. The bigger the audience, the more leads. On the Pay Per Lead Model, more leads mean higher profits. Simple.

I’ve had tremendous success running ad campaigns in “money for jam” niches. One of my Twitter ad campaigns generated 680 leads in just four hours.

I made $10,200 in half a working day. Overall, I produced 110,000 leads within that vertical, earning $2,598,980 at a 60% gross profit.

The best way to explain a “money for jam” offer is to give you some examples. Here are a few, based off the top of my head:

1.Compensation Niches.

These are also known as claims in the UK, or “mass torts” in the US. Mass torts are civil actions that have many plaintiffs involved against one or several defendant corporations. The claims (mass torts) industry actually paid for my house and wine cellar in one fell swoop, within 2 years.

There are multiple B2B and B2C niches within this space. For example, you could look at Personal Injury.

Why Are Personal Injury Claims or Mass Torts “Money For Jam”?

Personal injury can cover all sorts of issues, such as clinical negligence, employer liability and motor and road traffic accidents.

Personal Injury solicitors usually offer a free assessment for anyone who wants to know if they can make a claim.

Many also offer a “no win, no fee” deal. The legal term for “no win, no fee” is Conditional Fee Agreement (CFA). If the solicitor doesn’t win the case, the person who made a claim isn’t required to pay the legal fees.

Obviously, this is a very attractive option for the would-be customer:

- It only takes a few minutes to register interest in making a claim

- They don’t have to pay anything upfront

- The first consultation is free (something for nothing)

- They don’t have to pay legal fees unless the claim is successful (it’s risk-free).

2. Equity Release

Equity release is a way for older homeowners to access some of the money (the equity) that is within the value of their home.

Baby Boomers are now 70+ and living longer. They want to enjoy their retirement, and a lot of pensions won’t give them the luxuries they deserve. Equity release is a great way to get some extra cash, and it’s a vast industry.

I have quite a few students blowing their competition out of the water in this vertical, many of them using “long copy ads to a quiz” funnels.

Why Is Equity Release “Money For Jam”?

Over the last 30 years or so, the value of houses has risen dramatically.

In 1990, the average house cost around $70,000. In 2019, that same house would be worth $260,900.

If the owners have fully paid the mortgage, that means they’ve got up to $260,900 worth of equity in their home (though you must take into account house prices falling during a recession). Equity release allows homeowners to access some of this equity as tax-free cash. The amount they can borrow depends on the value of their home, how old they are, and where they live.

The most common type of equity release is a lifetime mortgage plan. That means there are no monthly repayments. Your program is only repaid through the sale of the property, if you die, or if you’re put into long-term care.

So, equity release counts as “money for jam” because:

- It only takes a few minutes to work out how much you can borrow against your home

- You don’t have to pay anything back during your lifetime if you don’t want to.

3. Grants

Again, we have lots of students that have been successful within the “grant” niche.

Many small businesses aren’t aware they can apply for grants, and get “free money” for things like research and development. Business owners have absolutely nothing to lose if they want to apply for a grant. All they have to do is put in the application time.

Why Are Grants “Money For Jam?”

Small and new businesses are constantly worried about funding. Grants come as a desirable option because they inject capital that doesn’t have to be paid back, apart from the fee as agreed with the lending business.

Unlike loans, grants don’t have to be repaid, and the business owner doesn’t have to surrender any of the company’s equity. As long as the grant is used as agreed, the business can press on without worrying about debt.

Grants generally range between a few hundred dollars to $500,000. If the grant doesn’t cover the entirety of the costs, the small business can see if they have enough money to cover the costs themselves, or they can apply for a loan.

The “money for jam” benefits are:

- They don’t need to pay back the grant money, apart from the agreed fee

- Grants from a reputable organisation can give a small business prestige.

The business can amplify this benefit through a promotional strategy that highlights the award. This marketing technique can bring in business they otherwise wouldn’t get.

Other “Money For Jam” Industries

- Pension Transfer: As people are living longer, pensions don’t last through retirement. One way to save money is by transferring your pension to another provider. You can choose a pension option you want, pay less in fees and combine pots to simplify your accounts.

- Debt consolidation: It’s definitely recession-proof, and you can get a brilliant cost per lead.

Other “Booming” Industries That Work During a Recession

If you’re still unsure about “money for jam”, or you want to find an industry that’s closer to the one you’re working in at the moment, here’s a list of niches that are still profitable during a recession.

1.Anything Insurance-Related

Life insurance, home insurance, income protection, you name it.

During times of worry, people want to protect what they’ve got. For example, during a worldwide pandemic, people may want to consider investing in life insurance.

Essentially, any insurance niche is fairly recession-proof. Insurance companies tend to be economically conservative, and people will need insurance whether the economy is up or down.

2. Consumer Lending (Secured or Unsecured)

This one is pretty self-explanatory. During an economic downturn, more people will look for loans because they need extra money.

For the sake of finding your niche, here’s a quick explanation of both:

- Secured loans. This type of loan is referred to as “secured” because the lender will require something as security in case the loan can’t be paid back.

- Unsecured loans mean you borrow money from a bank or a private lender and agree to make regular repayments until the loan is paid back in full. Unsecured loans tend to charge more interest than secured, but your house isn’t definitely on the line if you miss a payment.

3. Business Lending

Businesses suffering from the recession may need a quick cash injection to keep afloat. Unlike business grants, a loan will need to be repaid, so it’s not “money for jam”.

Interest rates depend on the lender, and the amount that can be borrowed varies from company to company.

4. Distressed Property Sales

A “distressed property” is any property that’s under foreclosure or being sold by the lender.

Typically, a distressed property is the result of a homeowner being unable to keep up the mortgage payments. However, it could be a case of the homeowner needing to sell the house to pay medical bills, debts, or any other financial emergency. Distressed properties are usually sold below market value.

In an economic downturn, firms promising to help with distressed properties can be lifesavers. During a recession, some people may need to sell a property quickly to pay other bills.

5. Online Learning

During a recession, people may lose their jobs, or won’t have the same amount of work as they did before.

With more “free” time, lots of people choose to learn new skills to implement when the economy recovers. This will increase their chances of getting hired when companies are advertising again.

Pretty self-explanatory. My Pay Per Lead Agency Blueprint is an excellent example of an online educational course.

Lots of you may have seen my ‘free training funnel here: https://learn.flexxable.com/free-training/. Many people, like me, would be willing to ‘per lead’ for a case study optin. The education market is huge. Why not reach out to a few educators and see if they are receptive to performance based lead gen?

6. Home Security/Improvement.

When a recession hits, people will look to improve their homes rather than move house.

Examples of home improvements include:

- Home security

- New windows/doors/flooring/roofing

- Spa installations

- Conservatories

- Solar panels

Still not sure which Industry to dive into? Remember to grab my extra List of Booming Industries!

[maxbutton id=”3″ ]

Now, let’s move on to choosing your “recession-proof” vertical.

How To Choose Your “Recession-Proof” Industry

When it comes to choosing niches, my first piece of advice is always “stick with what you know”. You’ll have an understanding of the industry, know the customers you want to target, and will have a good idea of what works in a sales funnel. You’ll also have a great “foot in the door” as you’ll have some clients in that niche already, plus you’ll be able to reach out to more with few problems.

However, some of you may not have that experience, or you need to change your niche due to an economic crisis.

If you’re starting out in a niche you’re unfamiliar with, don’t try to play with the “big boys” too early. During a recession, the marketing firms with deep pockets will go all-out to bring their client/company up to the top.

Many of the industries I’ve talked about are extremely competitive. Some lead generation agencies have been honing their skills in that niche for decades.

But don’t be discouraged. There are still ways to make plenty of money, even in a competitive vertical.

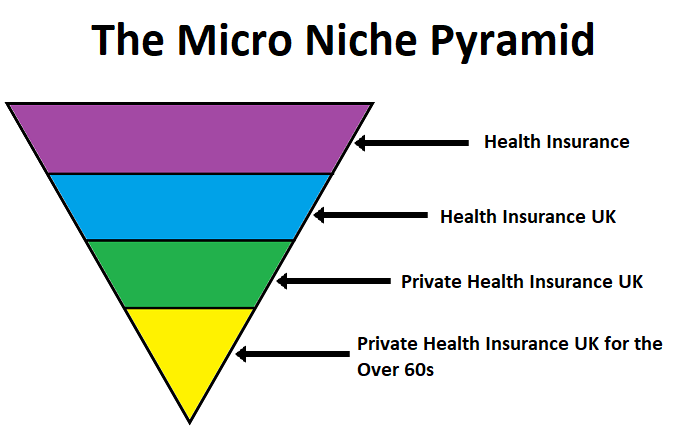

Once you’ve found a niche you want to work in, it’s time to narrow it down to a sub-niche.

A micro-niche, sub-niche, or niche-within-a-niche are all names for a smaller segment of the niche market.

Opting to devote your time to a smaller segment doesn’t mean there’s less money in it for you. Instead, you’ll find there’s still plenty of demand, but much less competition.

Going back to my “recession-proof” insurance example, a quick Google search will tell you that insurance is a MASSIVE niche. But, if you break “insurance” down, you’d soon find tens of industries that apply to the insurance sector.

- Health insurance

- Life insurance

- Income protection

And so on.

Do your research into these industries and see which one interests you the most. And, once you’ve chosen your industry, break it down again.

For instance:

- Health insurance > Health insurance UK > Private health insurance UK > Private health insurance UK, self-employed.

Or

- Income protection insurance > Long-term income protection insurance > Long-term income protection insurance for the over 60s.

Seems pretty specific? You’ll actually be far more successful if you drill down to a micro-niche within a broader market.

Follow this pyramid guide as a template:

The great thing about the “niche within a niche” strategy is that you can do it with any market, including “money for jam” industries.

Flexx Digital has generated hundreds of thousands of leads and multiple 7-figures in revenue from sub-niches. All it takes is a little homework and thinking outside of the box.

If you want to find out more about micro-niches and how to find them, you can visit these posts here and here.

Why You’re In a Time of Opportunity

I won’t lie to you – the economy isn’t looking good right now.

But, and this is the truth, digital marketing can and will thrive, despite what the recession throws at it. In fact, I would go as far as to say that digital marketing is in the top 10% of professions least hit by the economic crisis.

In the past, recessions have hit advertising businesses where it really hurts. In the last “big” recession (about ten years ago), online advertising plummeted by 27% in just two years.

On the plus side, the 27% drop was likely from the “big players” in advertising – i.e. car manufacturers, food and drink companies, and so on. For small lead generation or advertising agencies, the drop wouldn’t be as severe.

In the land of digital marketing, we’re used to things changing by the day, not the decade. Online advertising is much more mature and proven now, and we’re able to keep up with whatever life throws at us.

Here are five reasons why you shouldn’t despair:

1. Media Costs are Lower Than Ever

Media costs are cheaper than I’ve ever seen them. For many small businesses selling “luxury goods or services”, the first thing they’ll do is pull the plug on advertising.

With less competition across all platforms, media costs have plummeted. In one of my verticals, I regularly paid $10 per lead. Now, my cost per lead is more like $2.

Some industries have been wiped out (for the moment) due to the recession. Travel companies, car-hire firms, oil companies… the list goes on. Though it’s less than ideal for the businesses, their adverts are no longer taking up the lion’s share of social media space.

Take advantage of this opportunity while you have the chance!

2. Your Overheads Aren’t As Big As Some Other Businesses

Look, right now everyone is in the same boat. Every business is hurting right now, but digital marketing is hurting much less.

Being slightly personal here…

I have two brothers who are incredibly successful businessmen.

One of my brothers owns about 10 or 11 gyms and coffee shops. Due to the current recession, he’s had to shut all of them down. As he’s not making any money, he’s had to let go of almost 50. He’s devastated.

My other brother put his life’s savings into a Ninja Warrior-esque kid’s indoor play area. He opened a week before the current crisis, and he’s had to close down. He’s lost a crucial few months of revenue, at least.

I have to pay my staff, but we can all work at home. We all have the equipment we need to carry on with our jobs. If I need to contact anyone, they’re only a Zoom, Slack or Skype call away. Having an office to work in is our “hub”, but we don’t need one when the chips are down.

I’m incredibly lucky to be able to keep things running from home.

3. Online Marketing is Way, Way Cheaper Than Offline

This also applied to my first point, in terms of reduced media costs.

But, for my clients, offline marketing is an expensive waste of time right now.

Before the recession hit, one of my students managed to land himself a client in the legal sector. The client had a case type he was trying to make into a nationwide offer.

He’d already written off any form of social media marketing (a big mistake), and, instead, dropped $50,000 on a mailer.

The guy didn’t get a single case. Worse, he didn’t get a single lead either.

If that was bad then, it would be worse now. With people confined to their homes due to lack of money, or unemployment, they’re not going to see newspaper ads, posters, or take action with an expensive mailer.

However, I guarantee all these cooped-up guys are going to be on Facebook, Twitter and YouTube.

An online marketing campaign is easier and quicker to set up and monitor than an offline campaign. This is true during economic boom OR bust – but when clients want to save money, it’s worth remembering.

4. Your Targeting Skills Mean You Can Cut Right to the Chase

Businesses blow a tonne of money every year advertising to people who couldn’t give two hoots about what they’re offering.

The superior targeting ability of online marketing will allow companies to spend their (reduced) marketing budgets solely on likely prospects. With your lead generation experience, you can put your marketing efforts into behavioural targeting and retargeting for online ad placement.

5. Digital Marketing is Versatile

Nothing about a digital marketing strategy has to be fixed. If a PPC ad isn’t working, you can take it down and create more.

If you’ve scheduled an email, but don’t think you have the staff or finances to handle the response, you can delete it.

Even stuff like banner ads, advertorials and quiz funnels can be put up or taken down depending on budget and time factors.

And, even better, if something’s really working, you can leave it up. A well-crafted Facebook or YouTube ad can bring in leads for months..

When it comes to other forms of advertising – TV, radio, newspaper ads, etc. – managing them is a full-time job. And just try cancelling any of them at the last minute!

Digital advertising promises a world of opportunity, recession or not. Compared to most businesses, you have it made in the shade. So, keep your head up, stop complaining, and be prepared to make a real difference in your agency.

Now, let’s move onto the next section of this post: working out how much to charge per lead in your industry.

How Much To Charge Per Lead In Your Recession-Proof Niche

One of the most common questions I get from people new to the Pay Per Lead model, or starting in a new niche, is: “how much do I charge per lead?”

In truth, every industry is different, and there’s no one-size-fits-all answer. Most people learn how to calculate their cost per lead within a few months of experience.

However, that method often comes at a cost. I’ve known people plugging away for months, only to find they’ve been making half the profit they could.

Luckily, I’ve come up with a simple calculation that can be used across all niches. This formula is a general rule of thumb only, so you should adapt what you charge after you’ve got the experience.

The calculation goes like this:

- Work out the Average Order Value (AOV) of the customer. E.g. in some industries, a converted lead could be worth $3000.

- Divide the AOV by 3

- Figure out the 5% conversion rate.

3000/3 = 1000

5/100 =0.05

0.05 x 1000 = 50

So, if the AOV of a converted lead is $3000, you should charge about $50 per lead.

The opportunities for huge profit here are tremendous. If the client only wants a small order, like 100 leads a week, you could be making $5000 per week, from just one client.

This is just a ballpark figure, but it’s a good place to start.

If you’re still unsure about lead prices, you could compare the average price per lead on Google.

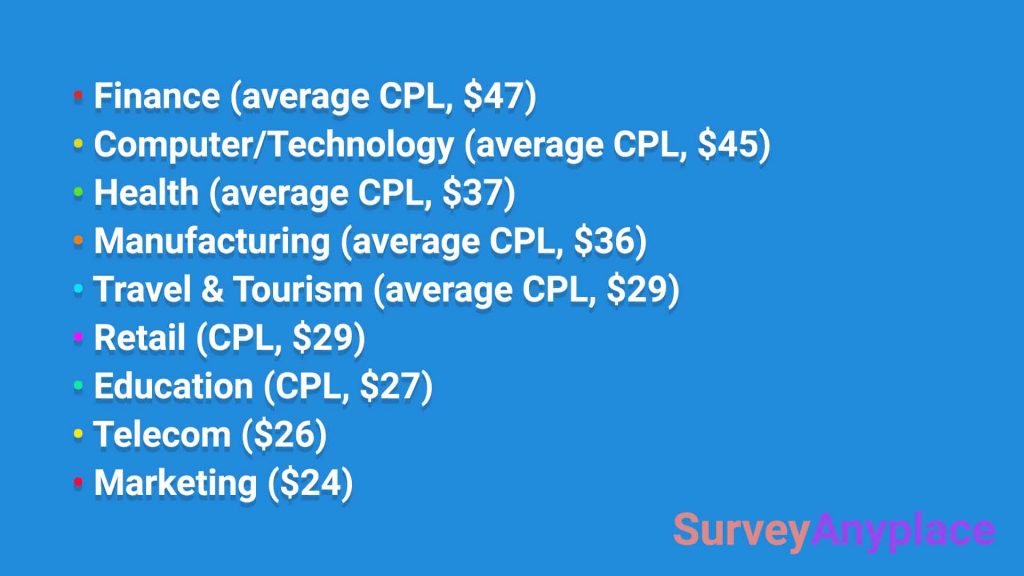

In SurveyAnyPlace’s helpful infographic, they have collated data from 22 influential lead generation articles to find the average Cost Per Lead in a selection of industries.

Here are the industries they looked at:

Of course, these figures reflect how much the average lead in that industry costs to generate, so you would charge your client more.

However, as you gain Pay Per Lead experience, you’ll find your CPL becoming much lower than the average. These figures include guys who have no idea what they’re doing, with almost zero experience in marketing.

As your CPL gets smaller, you’ll find yourself making bigger profits. It all comes with time.

Overall, I prefer my calculation method for working out how much to charge per lead. It may not be 100% accurate, but it will give you a solid figure as a starting point.

However, you can always use the above infographic (or other research) to see if you’re in the right ballpark. If, for example, you use my calculation and you think it’s too low, you can compare the figure against the above information.

Once you’ve chosen your niche, and know roughly how much profit you stand to make per lead, it’s time to get yourself some clients.

I’ve got two ways of doing this: cold/direct email and direct mail marketing.

I’m going to explain how to do both, so let’s move on.

How To Get Clients With Cold/Direct Email and Direct Mail

1. Using Direct Mail To Get Your Clients

I’ve talked about the power of using direct mail before, so I don’t want to linger for too long on this subject.

Many agency owners say that direct mail doesn’t work anymore, but I haven’t found that to be the case. Flexx Digital has used direct mail to get clients for years, and this method has helped us generate 7-figures in yearly revenue.

The real reason why so many long-form sales letters fail is because the writer has no real idea of their offer or how to communicate it.

When writing your direct mail sales letter, you need to point out the many benefits of the Pay Per Lead model and sell yourself as an investment.

Reasons to use direct mail:

- It’s easy to do

- It gives you quantifiable results.

- Not all of your prospects will use Facebook or LinkedIn. And, because fewer people use direct mail now, you may even find you get a better response rate than with email. Clients enjoy the novelty of it, and the personalised touch.

- Direct mail isn’t going to get regulated any time soon, even with GDPR

- The costs are both low and predictable – paper, envelope, stamp and a little ink

- Once you’ve cracked the formula, you can replicate it with little fuss.

When creating your letter, the first step is to work out how many letters you need to send every week.

Flexx Digital sends out a minimum of 25 to 30 letters a week, to business owners in a range of verticals. If we stop sending mail, we soon see a dip in our results.

Of course, we’ve spent many years honing our sales letters, so we don’t need to send as many to get our ideal response rate.

For newbies, a 3% response rate is a strong start. From that 3% response rate, you should look at converting at least 10% into clients.

That means each letter needs to get you about 10 prospects on the phone. That translates to 320 letters a month, or 64 letters per week.

To get your mailing list, you have three options:

- Look for business associations in your industry, and seek out their membership directory

- Buy a mailing list online

- Go to Upwork.com and hire someone to make a mailing list for you. These lists are highly targeted, so the more details you give, the better.

If you choose Upwork, which is my favourite method, the person compiling the list will send you a small sample of data. If you’re happy, you’ll receive a spreadsheet of contacts within a few days.

I’ve used this mailing list method frequently for years, and we’ve always had excellent results for reasonable prices.

Writing your first letter won’t be easy, but you can find tonnes of examples with a quick Google search.

I also have a highly split tested direct mail template in my course, The Pay Per Lead Agency Blueprint. This template is guaranteed to get you results, and takes away hours of writing, drafting and frustration.

All you need to do is replace the appropriate blanks with the vertical you’re working in. That’s it.

I’ve had students fiddle with this template before, and rewrite it in the way they think it should be written. These are the same students who contact me asking why they’ve not landed any clients yet.

This direct mail letter works. It’s responsible for some of my highest-paying clients, and I’ve shared it with every single student who’s come into my programme. The ones who trust the process are the ones who get the best results.

If you want to write your own direct mail letter, here are the three key elements:

- The headline (make it short and to the point)

- Your offer (Clients fall over themselves for Pay Per Lead)

- Your proof (screenshots, testimonials, videos).

And don’t worry about the length. As your skills and services are an investment, landing big clients means convincing them to take out their wallets.

If they’re genuinely interested in your offer, readership won’t drop off until the 3000 word mark. Keep highlighting the benefits, and explain why the Pay Per Lead Model is risk-free in comparison to retainer contracts.

For an added pro-tip, write or stamp “CONFIDENTIAL” on the envelope. This will get it past the secretary and straight into the hands of someone who knows how and when to take action.

Lastly, be patient. Letters can take two or three weeks to get results. You may find yourself getting custom months after you sent your first batch of letters.

If you’re in doubt, initiate contact on LinkedIn first, then send a letter once there’s proven interest.

2. Cold Email and LinkedIn Research

Like direct mail, cold or direct email works very well for us at Flexx Digital. We have a client who spends the equivalent of $15,000 a week with us, and they’ve been a client for about three years.

As a general rule of thumb, 1000 emails every month will get you about 5 new clients.

Though that doesn’t sound like many, it takes virtually no effort to automate an email system once it’s been written.

Plus, if those clients are “big-hitters”, your agency could be making thousands of pounds as a result of direct email alone. If every client pays you $10,000 a month, that’s $50,000 from one email sequence.

If you choose to use cold/direct email (and I highly recommend that you do), it’s essential that you target the right people.

Identifying Your Target and Their Pain Points

Most agency owners find potential clients via LinkedIn. But before you dash off a message to the first person you see, think about the following:

- Who do you want to directly target? The owner of the company? The marketing director? Choose whoever you think has the power to take action.

- For small companies, always contact the CEO directly. A secretary or executive assistant often acts as a “gatekeeper”, and will delete any emails they feel are a “waste of time”. Even if they do pass the message on, it won’t have the same impact as the CEO directly receiving your email.

- If the company is larger, consider sending the same message to multiple people. That could include the CEO, the head of Marketing, the head of Finance, or whoever else may be relevant. The idea is to get your message in front of interested eyes.

- When using LinkedIn for your research, take advantage of their “negative keywords”. When you’re searching for the CEO of a company, you’ll find secretaries and executive assistants turning up in the search results. You can omit these “negative keywords” and get the info for the people you need.

When you think you’ve found suitable prospects to target, you then need to think about the key “pain point” and use it as your hook.

Our hook concentrates on the benefits of the Pay Per Lead Model in comparison to retainer contracts.

See, with retainer contracts, as I’ve mentioned, clients are often tied into:

- Long-term commitments

- A minimum ad spend

- Charges for landing pages, thank you pages, etc.

And more. So, the client will be looking at paying a five-figure sum upfront without a shred of evidence that your performance will be “worth it”.

With the Pay Per Lead Model, the offer is delightfully straightforward:

You offer the client 100 leads at X price. Let’s say $50 per lead.

If the client says yes, they are guaranteed 100 leads on a no-risk basis, as you’ll be paying for the ad spend. (Does this remind you of “money for jam?”).

You then manage to generate 100 leads for $25 each, giving you a profit of $25 for every lead you generate.

That’s $2500 profit for a minimal amount of leads.

Meanwhile, the client has spent $5000 on 100 leads. With a high-ticket offer, just one converted lead could mean making back double that amount.

Essentially, the client loves the Pay Per Lead Model because they’re paying for leads and nothing else.

If they like your service, they’ll continue to use you. If not, they’re not bound into a three-to-twelve-month contract.

This is very attractive to potential clients, and especially during a recession. Businesses want to be among the ones that SURVIVE, while everyone around them is drowning.

If they can afford it, they’ll want to buy as many leads as possible to keep themselves afloat. Equally, the fact they’re not bound into a contract if the going gets financially tough eases a lot of worry.

You need to make this compelling argument in your cold/direct email, as it’s guaranteed to spark interest.

I also provide cold email templates in my course, The Pay Per Lead Agency Blueprint. Like the direct mail, these email templates have been split tested over a number of years to maximise conversions.

I will talk about the email sequences that are guaranteed to convert a little later on.

How To Get Email Addresses To Build Up Your Database

Before you send any emails, you’ll need to build up a database of contacts.

Our go-to is LinkedIn. You can use the free version of this platform, though you’ll find the options much more limited.

I highly recommend Sales Navigator, as it gives you the best searching options. There is a 30-day free trial available, and it’s $79.99 a month thereafter. However, the 30-day trial is enough to about 3-4 months worth of data, which is an excellent start.

What To Include In Your Cold Email

Once you’ve got your data from Sales Navigator, it’s time to go through and add the all-important details that will go into your email.

When you send your cold email, you want to make it personal. We’ve found, through trial and error, that the magic number is around 3-6 personalised points per email.

If you send a basic template message, you’ll naturally get less response than if you added in a few personal details. However, too many details will also reduce response rate. We found that 6+ personalised points were too many for our prospects.

Keep the personalisation really simple, and stick to the following three facts:

- The recipient’s name

- The industry

- The name of their company

Really easy stuff, but enough to make the prospect believe you’ve done your research.

NOTE: When typing the company name, avoid including anything like “PLC”, “LTD” or “LLC”. It comes across as very formal or, worse, like you’ve copied and pasted it directly into your email. You will have, but the idea is to make the prospect feel like it’s a personalised message.

Next up, set up a new email account on a new domain. Using LinkedIn, you could be sending hundreds of emails a day, every day.

A new email account on a new domain will prevent emails from getting lost, or going into spam. It’ll also keep your prospecting work and other email conversations separate from each other.

The cold email game takes work and careful monitoring. The last thing you want is to miss out on working with clients because you got bogged down in a swamp of emails coming from here, there and everywhere.

A separate domain can also keep your reputation safe from harm. If you’re targeting 400 people per day (for example), then you’re going to receive complaints from time to time. You don’t want these complainers to look at your official email address and form negative associations.

The alternative email address doesn’t need to be misleading. For example, I have email addresses under @flexxable.com and @flexxable.co.uk.

Here’s a quick list of all the other pre-email work you’ll need to do before you get the ball rolling:

- Ensure you don’t contact more than 1 contact per company, per day. If the business has more than 1000 employees, you can send 2 – but that’s the maximum.

- Write your awesome email template

- Perfect your email signature. It should include your name, number, email address and link to your website. Give the potential client every opportunity to find out more about you. If you have a case study, you should definitely include it in the signature (not the main body of the email).

- An opt-out. This is GDPR policy in the UK. If you let the prospects opt-out, it will reduce the number of complaints thrown your way.

- A private policy. This is particularly important in the UK, as you’ll need one to be GDPR compliant.

Finally, your cold email sequence should be 4 messages long. This includes:

- The initial email stating your offer

- A nudge for anyone who didn’t reply to the first message

- A request for a referral

- One final call to action (CTA)

Email 1:

- State the potential client’s pain point, then give them your offer

- This email should be personalised and kept simple. Avoid marketing jargon if you can

- Tell them why you’re an expert at what you’re offering

- Include a call to action.

Here’s an example email 1 template. Obviously, you would need to change the subject depending on your niche and offer, but it’s a perfect example.

Dear [FIRST NAME]

I hope you don’t mind the direct approach on a busy [WEEKDAY] morning. I was looking for the right person at [COMPANY] to introduce our service to, and I came across your profile.

I am working with other [SIZE] organisations similar to [COMPANY NAME]. One of the key issues they struggled with was having a constant flow of leads for their sales guys to work on.

At [YOUR COMPANY], we generate high-quality leads on a range of platforms, including [NAME PLATFORMS]. All of our leads are tailored to your specific requirements (I can explain all!)

We’re a very sophisticated outfit. I think we can help, and it would be great to run through a sample funnel from the [INDUSTRY] space if you have a moment.

Perhaps you might have a few minutes [TIME, EARLY OR LATER] [THIS OR NEXT] week for a brief chat?

Best regards,

YOUR NAME

Notice how I’ve used personal details, such as the potential client’s first name and setting a time to chat. This has far, far more results than a simple “respond to this email if you’re interested”.

Email 2:

Your second email should be a polite nudge to anyone who didn’t reply to the first email.

This step is absolutely crucial. While your first email will have a response of roughly 18-20%, your second email can generate a 25%+ response rate.

The second email should be a forward of the original message, and sent about 4-6 working days later.

Email 3:

Email 3 should take a slightly different approach.

In this case, I like to ask for a referral. Something short and sweet, such as:

I don’t want to keep bothering you if you aren’t the right person. Could you please let me know who in the company deals with [XXX].

If you receive a response, always follow up on it to the next person you message. “[NAME] told me to get in touch” gets a better response than starting cold again with email 1.

Keep the subject line super simple for this email. I recommend just putting the name of your agency. E.g. “Flexxable”.

Email 4:

Any more than 4 emails, and you’ll find the negative responses really start to ramp up.

With this, your final email, aim to get a response – even if it is negative. You can always reach out to these prospects again in 3 to 6 months’ time.

Keep this email light. Don’t show any signs of being desperate for, or annoyed by the lack of, a response.

Here is another example:

Hello [FIRST NAME]

I’m sure you have a thousand things to do, and I don’t intend to be a pain. I’m just following up on my earlier emails. I would love to take you through our service and generate leads for [COMPANY NAME].

Please tell me if:

- You’re all set, and I should stop bothering you

- You’re interested, but haven’t had time to respond yet

- I should follow up in 3-6 months

You’d be surprised by the level of response! There could be up to a 24% response rate, with many opting for 2 or 3.

Now we’ve looked at some email examples, let’s take a look at a very useful tool, SoPro.

SoPro

SoPro is a service that will do all of the above for you, without any hassle.

Firstly, SoPro defines your ideal prospect. From there, they build a list of suitable contacts, and their copywriting team will draft the email sequence.

SoPro promises to target 50 to 100 qualified prospects every day.

Once you’ve got fish on your hook, SoPro leaves you to close the deal as you normally would.

To reach your ideal prospect, SoPro follows this process:

- Planning and set up

- A full market assessment

- Prospect identification

- Technical set up

- Exceptional messaging

- Daily outreach

- Tracking and chasing

- CRM integration

- Optimisation

If you wanted to use SoPro, this could take your prospecting to the next level – especially if you combined it with your own email efforts.

Be aware, however, that expert help comes at a cost. With SoPro’s help, you’ll easily make up what you spend with new clients. However, if you’re just starting out, I recommend leaving SoPro until you become a Pay Per Lead “pro” yourself.

Okay, so you’ve chosen your niche, you’ve worked out roughly what to charge per lead, and you’re ready to fire out some emails.

It’s time to learn how to close clients.

The Different Types of Payment Model

You’ve found your niche, reached out to prospects, and landed your first client.

Congratulations! You’re officially doing better than 90% of other businesses during a recession.

However, one of the most common questions I’m asked is how to charge for leads. On a retainer contract, it’s easy. You agree to a sum with the client, who then pays you weekly or monthly depending on the contract.

Due to the nature of retainers, the sum is unlikely to change – even if you go above and beyond.

With the Pay Per Lead Model, however, there are 4 key ways to charge for your leads.

The first three (hybrid, front-end and back-end) all depend on the level of experience you have within Pay Per Lead.

For beginners, I highly recommend the hybrid model. This model is the closest you’ll find to the retainer contract manner of payment. This is because you don’t pay for your ad spend. Instead, you agree on a commission per converted lead.

As you gain experience in Pay Per Lead, you may want to switch over to the front-end model. With this model, you do pay for your ad spend. However, you get to name a price per lead, and the client will pay that fee whether the lead converts or not. The front-end model is the one I use, and it’s the model I most frequently refer to when I talk about PPL.

Finally, the back-end model is the riskiest of all the payment types. In this case, you pay for all the ad spend. You then agree to a commission fee per converted lead.

If that sounds like a rough deal, I can assure you that the back-end model is hugely profitable – if it’s done right. For this model, you must be at the top of the game in your chosen niche.

I’ll now go through each model one by one. In this section, I’ll explain what each of them is, the benefits of each, and the risks.

1. The Hybrid Model

As I said, this model is preferred by Pay Per Lead beginners as the risk is much smaller.

With this model, you ask the client to pick up the advertising spend. You’re still responsible for building the funnels and running the ads, but you don’t have to shell out from your own wallet.

Say, for example, the client agrees to pay $5000 per week on advertising spend. It’s then up to you to generate as many high-quality leads as possible for that figure.

When the client receives the leads, the sales team will try to convert them. For every converted lead, you’ll receive an agreed fee.

Clients love this kind of deal because they know they’re getting plenty of bang for their buck.

A $25 lead may be worth $3000 once converted into a customer. If the client has agreed to pay you 10%, you’ll get paid $300 per converted lead.

And 10% is pretty low – I wouldn’t recommend going any lower. I’ve worked with the hybrid model on several occasions and, sometimes, I get paid up to 25% of the converted lead. It’s all about good negotiation.

That said, don’t push too hard. Clients also have to pay for their overheads, and they’ve already shelled out for advertising spend. So, anything between 10%-25% commission is a fair deal.

Of course, as with all models, there is an element of risk.

Number one, and this is the most important: if your leads don’t convert, you’ll get paid nothing. This is unlikely, but I’ve seen people with bad creative or shoddy funnels come out of these deals looking worse off.

Number two: you need to have a good relationship with your client OR will need access to their CRM system. I’ve only heard of clients stiffing lead agencies once or twice, but it can happen. They’ll claim that only X amount of leads have converted, whereas the figure is closer to Y. Access to the CRM means you’ll be able to keep an eye on conversions.

Number three: you may have generated some red hot leads, but the sales team fails to convert them. Sales teams contain people (haha), and people are unpredictable. A couple of hangovers or some sickness in the team can reduce the chance of your leads being converted. So, just be aware.

2. The Front-End Model

This model is the best option if you’ve got experience within your niche. It’s also the most used method of charging clients at my agency, Flexx Digital – one I highly recommend.

For example, you may be generating leads for a solar panel installation company, and you know you can get leads for about $10 each.

In this case, you can confidently speak to a new client about how many leads you can generate, the quality of the leads, and how much you would want to be paid for them.

Because you have already had experience in this industry, and you know how much to charge per lead, this is a super easy sell.

How This Works

The client will confirm the number of leads they are looking to buy for the following week, i.e. 100. You will then invoice them upfront for the total amount of the leads at the agreed price.

I usually ask the client to put the money in my account by Friday. I’ll then switch on all ads and funnels by Monday morning.

No money? No ads.

You’ll then spend the week generating the leads.

By the end of the week, the client should have the rest of your leads in their CRM system. If they’re satisfied with the contact and conversion rates so far, confirm with the client how many leads they want for the next week.

Rinse, wash and repeat.

If the client wants 210 leads/week @$20 a lead, you know you need to be generating around 30 leads a day.

You need to make sure that you’re generating leads below the invoice price ($20).

If you generate leads above the invoice price, you still need to give them to the client. You’ll also have to absorb the additional costs.

Let Me Give You an Example:

My offer would be: 30 leads a day, 7 days a week @ $20/lead.

You can generate leads @ $10/lead = $300/day in advertising costs.

You will then sell these leads to the client @ $20/lead = Total Revenue = $600

Profit = Total Revenue – Advertising Costs = $600 – $300 = $300 profit/day

Do this over 30 days/month, and you will be clearing $9,000 profit per month.

3. The Back-End Model

So, this is the ultimate “paid on performance” model.

When you’re in a back-end deal with a client, you pay for the advertising spend.

You know you can generate 100 leads for roughly $50 or less per lead in a week. So, you pay the $5000 advertising spend, set up the funnels, build the ads, etc. You then deliver as many leads as you can for that spend. The client will try and convert the lead, then will pay you commission for each lead converted into a customer.

If they’re a high-ticket client, they could be making as much as $20,000 per conversion. If you get 10% of that, that’s $2000.

Ten converted leads out of 100 = $20,000. Minus your ad spend ($5000), and you have a $15,000 profit per week.

This model is a no-brainer for clients, and it’s the easiest sell in the world. However, unless your offer is super dialled-in, I’d avoid at the beginning.

See, this model comes with plenty of risks.

Firstly, you’re paying for the advertising spend. If something goes horribly wrong and your leads fail to convert, you could be thousands of dollars out of pocket. The people who offer clients back-end deals usually have tons of experience in their niche, and have great templates for ads and funnels from their past work.

The other risks are the same as with the hybrid model: you must trust your client or have access to their CRM system. Conversions depend on the competency of the sales team.

You’ll also need to wait longer to get paid. Depending on the sales cycle, you could be waiting for a week to a month.

However, if you’re up to date on your lead segmentation skills, a back-end deal could come in useful.

4. The “Package” Model

The package model is very different from the other three.

This model is essentially a call-centre that sits between the lead and the client. So, rather than send the lead directly to the client, it’s sent to this “package call centre” instead.

The call centre then works the lead and makes it “red hot” (super interested). Once the prospect has nibbled the bait, the call centre then sells it onto the client for 5-20x what the lead cost to produce.

You can also do something called “hot keying”. This is when the call centre works the lead until a certain point. When the lead has reached that point, the call centre transfers the live call over to the client to close.

Prices for leads can differ depending on the industry and the quality.

Essentially, if you choose the package model, you can have more of a hands-on approach in the entire sales process. For example, you could introduce your client to technology such as 2-way SMS, Bonjoro, Active Campaign, and so on.

You’ll find that clients will be so happy to have someone innovate their sales process with tech, they’ll pay the extra price with few complaints.

Remember that anything they spend on your services, they’ll make back tenfold, so all your tech and sales skills are an excellent investment.

Here are the positives and negatives of pitching the package model to your client:

Positives:

- You’ll get paid more

- There will be more buyers

- It’ll add another string to your agency’s bow

- You’ll figure out the quality of your leads quickly

- Having a call centre will force you to be really good at what you do

- Market leaders will (eventually) buy your business

- Big clients may fund your costs

- You can use one call centre for multiple, related, verticals

- You can team up with other call centres to minimise your risk

- Hiring staff is usually fairly inexpensive

Negatives

- Most of the time, your own money will be at stake

- More people to manage – and human nature means some bad days

- Can be expensive to run depending on the software you’re using

- Will take a while to “settle in” and hit your stride

- Will also take time to understand your vertical to a “package model level”

- Not really an option when you’re just starting out

However, if you know what you’re doing and have a good understanding of your vertical, the package model can be insanely profitable.

If you can’t afford it now, it’s definitely something to set your sights on in the future. I think the package model could be an achievable growth and scaling point for Pay Per Lead agencies across the globe.

Now It’s Your Turn

An economic recession or not, there’s no excuse for not being able to find enough clients to grow and scale your agency.

There is still a tonne of opportunities out there to make money, and I’ve given you all you need to go out and grab it with both hands.

I would say the first thing you need to do it put everything in perspective. It’s easy, during a global financial crisis, to panic or to want to give up. This isn’t something that’s just happening within your agency. It’s happening to everyone around you, and the world as you know it seems to be in chaos.

I’ve had friends and family lose their livelihoods (temporarily or permanently) because of something they can’t control. It’s really easy to get washed away in a sea of sympathy and bitterness. You’re also watching the clock, wondering when it’s going to happen to you.

But, as I said earlier, digital marketing companies are doing better than 90% of businesses out there, right now.

The Pay Per Lead Model is virtually recession-proof, and there are plenty of potential clients out there who are hungry for leads and to survive.

So, no matter how you feel, no more excuses. Embrace the winds of change, and use this article to find clients with deep pockets. In this world, and especially now, you’ll only get out what you put in.

Now I’d like to hear from you.

How have you and your agency been coping during the recession? Do you think you have what it takes to thrive?

Do you have any special tips for landing clients that you think I should have mentioned in the article?

Tell me all in the comments below.

DON’T FORGET YOUR BONUS: The Pay Per Lead List of Booming Industries (Even During a Recession!)

[maxbutton id=”3″ ]